To effectively market to your ideal customers, it’s important to know more about who they are, right? Well, marketing data is the key that unlocks a world of information about your consumers.

To effectively market to your ideal customers, it’s important to know more about who they are, right? Well, marketing data is the key that unlocks a world of information about your consumers.

Ultimately, the insights provided by advanced databases infuse your auto marketing campaign with details that help your customers connect with your dealership and drive them to buy.

Luckily, the team at Epsilon Individual Automotive capitalizes on modern marketing data by offering our clients information gathered from our exclusive databases, including Real Time Credit Score Data.

Armed with this knowledge, you can target audiences within specific credit score brackets to enhance your automotive marketing strategy’s response rate and cost effectiveness.

WHAT IS REAL TIME CREDIT SCORE DATA?

First and foremost, let’s define what this database actually is. Put simply, Real Time Credit Score Data is a list that targets customers based on their actual credit score and credit information pulled from the three credit bureaus: Equifax, Experian, and TransUnion.

First and foremost, let’s define what this database actually is. Put simply, Real Time Credit Score Data is a list that targets customers based on their actual credit score and credit information pulled from the three credit bureaus: Equifax, Experian, and TransUnion.

How do we have access to such specific, accurate data? Well, we just so happen to be part of the number-one ranked global marketing and consumer database innovator, Epsilon.

Epsilon is a data marketing solutions company that has spent more than 50 years in the industry. Over that time, they’ve streamlined the data process to help us help you craft the most accurate marketing strategy to drive sales. Additionally, they’ve been ranked number one in transactional and behavioral data in the industry, furthering their abilities to provide the best, most accurate information possible.

Not only does this allow us to connect with top-notch data that offer unparalleled insights into your dealership’s audience, but it also sets us apart from other automotive marketing agencies.

HOW DOES IT WORK AND WHY IS IT IMPORTANT?

In today’s world, you need to go beyond the status quo to engage with your buyers. Sure, you can rely on results from your previous campaigns to provide you with information about your customers’ behaviors, but that’s really only scratching the surface.

By tapping into innovative databases like Real Time Credit Score Data, you’ll gain potential insights that your team can use to deliver personal, meaningful messages to your leads.

Instead of spending your team’s time and budget creating mass marketing materials that won’t hit home with most of its recipients, Real Time Credit Score Data allows you to pinpoint the credit scores of prospective buyers.

For instance, let’s say your dealership is looking to target individuals with low or no credit scores who may need some assistance with purchasing a vehicle.

Well, the credit information pulled by Real Time Credit Score points you to the leads within your data pool who would benefit from such an offer.

WHAT IS A PERFECT CREDIT SCORE?

When you’re looking to use Real Time Credit Score Data information to send marketing materials to a particular targeted audience, understanding credit scores is essential.

When you’re looking to use Real Time Credit Score Data information to send marketing materials to a particular targeted audience, understanding credit scores is essential.

For example, if you’re looking to target individuals with a perfect credit score, you’ll want to set your credit score range for those who have a score of 800 and over. Do you want to target someone with Fair credit who may have been turned away by other dealerships? You may consider targeting a range up to 669.

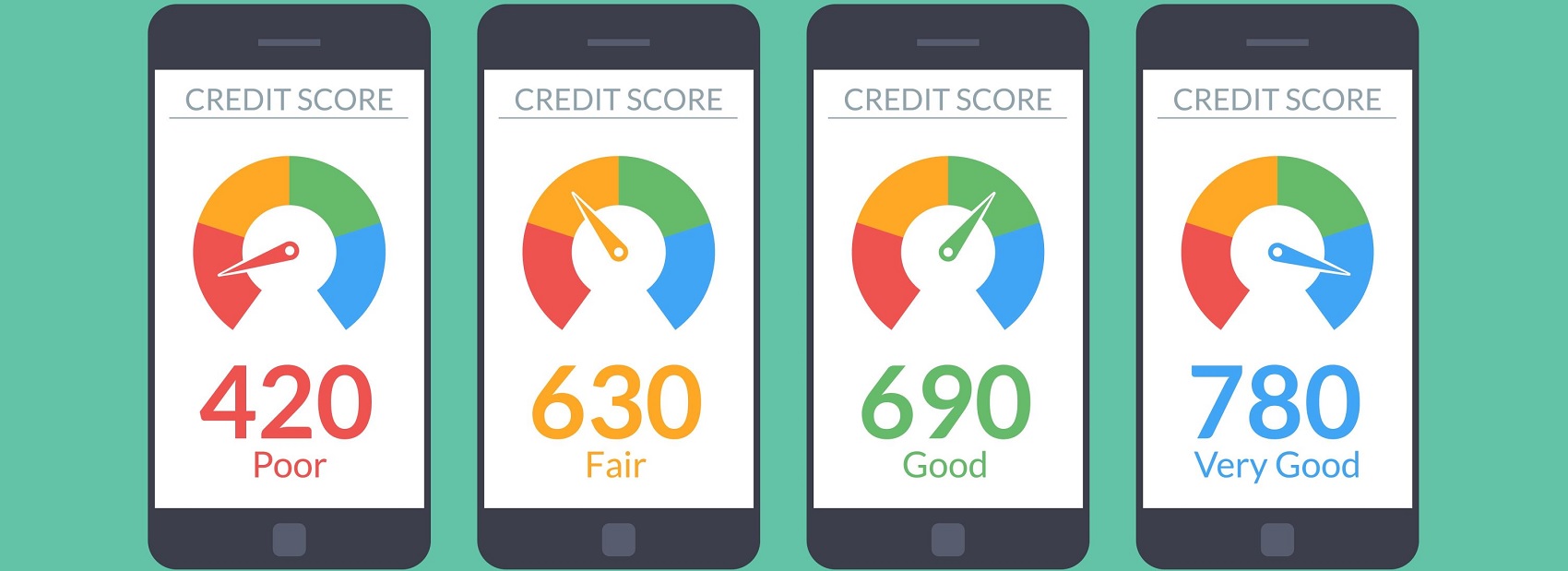

Let’s take a look at the ranges of credit scores:

- Excellent: 800 and over

- Very good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 580 and under

With this information in hand, you can more accurately send information to your targeted audience about pre-approval forms or financing promotions.

REAL TIME CREDIT SCORE DATA: ACCURATE CREDIT INFORMATION

Now, you may be thinking, “why can’t I use something like Credit Karma to pull my customers’ credit score data?”

Now, you may be thinking, “why can’t I use something like Credit Karma to pull my customers’ credit score data?”

The fact of the matter is that online tools that only collect credit data from two bureaus instead of three, like Credit Karma, aren’t nearly as accurate as the data accessed by the Real Time Credit Score database.

In addition, Credit Karma and other online credit portals don’t gather information from creditors, and creditors don’t report information to Credit Karma. For example, if you were to apply for credit through a bank—like a credit union—this information is reported to credit bureaus.

If you were to use Credit Karma to obtain the credit scores of those in your targeted audience, you’ll receive far less information than you would if you used our Real Time Credit Score Data information. Plus, without the essential details provided by creditors, it’s hard to say whether the information that your dealership is referencing in Credit Karma is accurate or not.

The best way to ensure that you’re accurately targeting the appropriate credit range for your automotive marketing campaign is to use a database that relies on data pulled directly from the three major credit bureaus.

WAYS TO USE THIS INFORMATION

So, you’ve gathered the credit scores of those in your areas, but now what? Why not take advantage of one of our popular credit promotions? You can customize the credit score range you wish to target. This is particularly easy, since our Experian or TransUnion lists are updated weekly.

With this updated credit score information in hand, you can now work with our marketing experts to craft a specific marketing strategy for your dealership. The Autoproval tool is one of these promotions our marketing experts can help you set up.

With the Autoproval promotion, you’ll select the credit score or credit score range you wish to target. From there, you’ll determine what type of loan the recipient is pre-qualified for. This simple promotion is a great way to bring customers through your door.

OUR AUTOMOTIVE-FOCUSED DATA

To better understand and market to your most valuable leads, credit score data is just the beginning. Why not take your Real Time Credit Score Data and complement it with information from our other industry-leading databases?

To better understand and market to your most valuable leads, credit score data is just the beginning. Why not take your Real Time Credit Score Data and complement it with information from our other industry-leading databases?

Each of these resources offers a unique perspective into your leads and their car-buying habits. You can use it to craft many different versions of your automotive advertising campaign that appeal to individual prospects and leads.

SUREDRIVE DATA

The more you know about your customers’ current vehicles, the better prepared you’ll be to market to them. That’s the idea behind SureDrive Data. This database reveals that information in the most granular detail. You can identify the specific:

- Make

- Model

- Year

- Auto style

The value doesn’t end there. You will also be supplied information on the purchase date and purchase type—meaning whether the shopper chose to buy or lease a vehicle.

With this data in hand, you can connect with high-intent customers in a way that is more relevant to them. Know more about their cars, and you can better predict what they’ll be looking for next.

LEASE/LOAN ENDERS

When it comes to marketing, you know that timing is everything. If you hit the customer with the right message but at the wrong time, you won’t see a conversion.

When is the right time, however? Lease/Loan Enders has the information you need to narrow down the timescale. This database gives you a better picture of your customers’ credit scores, as well as key insights regarding their lease or loan:

- Percentage of auto loan remaining

- Number of payment months remaining

- Any paid auto loans that haven’t been renewed

Think about how useful this data could be. Knowing how much time customers have left on their loans and leases allows you to pinpoint when they’ll be gearing up to buy their next new vehicle—and that’s when you want to deploy your marketing campaign.

DEALER DATA DOWNLOAD

The accuracy of data is essential for the success of your campaigns. You’ll have fewer duplicate and incorrect addresses in your database with Dealer Data Download, our system that retrieves and updates information in your Dealership Management System. Keep your records more accurate and improve your marketing efforts.

AUTOPROVAL

All that credit score information you’ve collected? You can put it to work automatically with Autoproval. Just choose a targeted credit score list, and the system will send out pre-qualified auto loan offers to eligible customers. It’s fully automated marketing at your fingertips!

SATURATION

Is your dealership new to your community—or do you feel like you never made a proper introduction when you first got up and running? Our Saturation list is the solution. Send a friendly welcome postcard to every home! Just choose a postal carrier route, and your automotive direct mail will be deployed to every mailing address in the area.

LEARN MORE ABOUT EPSILON’S DATA RESOURCES TODAY!

At Epsilon Individual Automotive, we pull out all the stops to help your dealership create automotive marketing campaigns that reach the right consumers at the right time with the right message.

With the assistance of our data-mining gurus and exclusive databases, our team can build an informed advertising strategy that gets you the most bang for your buck.

Start designing a data-driven, credit-focused auto marketing plan with our professionals today by giving us a call or sending us an email!